TWIMM: The Crypto Circus Hits Washington, oh and the Ukraine Breakup

Strategic Reserve or Strategic Pump? Plus, Trump’s Divorce Papers for Europe.

Welcome back chaos fans to This Week in Macro Mayhem, where we break down the latest Macro lunacy so you don’t have to. It’s Monday, March 3rd, and the chaos dial is set to maximum. We’ve got tariffs, Powell’s upcoming speech, China’s economic maneuvering, and… oh yeah, Trump’s Crypto Strategic Reserve play that has everyone either laughing, scratching their heads, or counting their gains. Plus I need to touch on the Zelenskyy meeting with Trump that’s bound to piss off my European friends.

Let’s dig in below 👇

Markets: The Hangover Hits

Bitcoin took a dive back below $89K this morning after a wild 20% weekend swing. The post-announcement pump has faded into the usual sell the news correction.

Global equities were mostly up, except China, which is flat, everyone’s waiting to see what policies emerge from this week’s National People’s Congress.

US equities, we had a early market rally that quickly fizzling out.

Nvidia was the only Mag 7 name in the red today, after reports surfaced that Singapore is investigating chip exports.

Euro Area inflation came in hotter than expected, throwing more doubt on ECB’s upcoming rate decision.

The Mexican Peso (MXN) and Canadian Dollar (CAD) are worth watching as tariffs kick in this week, retaliation is a real possibility.

Tariffs Incoming: Trade War 2.0?

Barring a last-minute change, new tariffs on Canada and Mexico (25% and 10% on energy, respectively) kick in tomorrow, alongside a doubling of China’s tariffs to 20%. These moves were supposedly priced in, but retaliation is not. Commerce Secretary Howard Lutnick has hinted Trump hasn’t even finalized the Canadian/Mexican rates yet. Because, you know, economic uncertainty is just so much fun.

China, meanwhile, is gearing up for its biggest policy event of the year, the National People’s Congress on Wednesday. Expect more deficit spending and consumption boosting measures. The European Council also meets Thursday to hash out Ukraine aid and possible fiscal rule relaxations, but Hungary and Slovakia might throw a wrench in the plans.

Powell Watch: Friday’s Speech Might Be a Big One

Fed Chair Jerome Powell is scheduled to speak Friday, and the key question is whether he sticks to his rate-cut pause or acknowledges that inflation’s looking stickier than the Fed hoped. Meanwhile, we’ll be watching Wednesday’s ADP payroll numbers (private-sector hiring) and Friday’s official US employment report, where a pickup in job creation is expected but recent weekly jobless claims suggest layoffs might be creeping up, especially in the DC area.

The Crypto Bombshell: Trump’s Strategic Reserve Gambit

Yesterday, Trump posted on Truth Social that he’s directing the Presidential Working Group to create a Crypto Strategic Reserve, including XRP, SOL, and ADA.

"A U.S. Crypto Reserve will elevate this critical industry after years of corrupt attacks by the Biden Administration... a Crypto Strategic Reserve that includes XRP, SOL, and ADA. We are MAKING AMERICA GREAT AGAIN!"

No mention of Bitcoin. No mention of Ethereum. Just 3 tokens with centralized elements and major corporate backers.

Predictably, markets went nuts:

SOL pumped 27%.

XRP jumped 34%.

ADA briefly surged 80% in hours.

Even BTC and ETH climbed double digits once they got a delayed mention.

The market response was instant, but this whole thing smells of corporate capture. What exactly makes XRP, SOL, or ADA strategic? Who benefits from their inclusion? Hint: not the public. Ripple Labs (XRP) alone saw its holdings increase by $30 billion overnight.

And then came Trump’s "oops, I forgot Bitcoin and Ethereum" correction:

"And, obviously, BTC and ETH, as other valuable Cryptocurrencies, will be the heart of the Reserve. I also love Bitcoin and Ethereum!"

So… the real reserve assets were just an afterthought?

White House Crypto Czar David Sacks later confirmed that this aligns with Executive Order 14178, and we should learn more at Friday’s White House Crypto Summit. Attendees include founders, investors, and executives which likely means Ripple’s Brad Garlinghouse and Cardano’s Charles Hoskinson will be schmoozing for public funds.

Bitcoin Reserves: The Right Way to Do It?

I’ve long maintained that a Bitcoin Strategic Reserve is worth considering… if done right. But public funds pouring into centralized tokens with questionable use cases? That’s a terrible idea.

A friend in my home state’s legislature asked for my input on Oklahoma’s proposed Bitcoin Reserve Act. Here’s what I told him:

Pros:

✅ Inflation hedge—Bitcoin is digital gold.

✅ Long-term capital appreciation—10-year CAGR over 100%.

✅ First-mover advantage—could attract business to the state.

Cons & Fixes Needed:

❌ Extreme volatility—cap holdings at 5% for a trial period.

❌ Poor liquidity in downturns—hedging strategies needed.

❌ No clear accounting guidelines—should follow FASB’s fair value method.

❌ Custody risks—absolutely no state-controlled private keys. Institutional custody only.

Bottom line? A Bitcoin reserve makes sense. A random basket of tokens does not. We’ll see if this new federal push goes anywhere, but right now it feels like an ill-conceived pump job.

The FDIC’s New Game: Hide the Problem Banks

In classic bureaucratic fashion, the FDIC will no longer disclose how many assets are held at "problem banks." Their excuse? It might cause panic.

This is like removing all the fire alarms from a hotel to stop people from panicking when there’s a fire. The only reason to hide the numbers is if they’re about to skyrocket.

Meanwhile, US banks posted solid Q4 profits up 2.3% to $66.8 billion. But if everything is so fine and dandy, why the secrecy? 🤔

Now on to the fireworks 💥

The Divorce Papers Are Signed, Europe

Americans have been screaming “no more foreign wars” for a long time, and yet here we are, still playing sugar daddy to Europe’s security blanket. Left, Right, doesn’t matter, nobody’s itching for a nuclear standoff with Putin over Ukraine. We’re done. Kaput. Ready to swipe left on this whole entanglement and ghost the group chat.

Historically, we didn’t even want to be Europe’s babysitter, post-WWII was supposed to be a one and done intervention, not a 70-year Netflix and chill subscription to their defense budget. But the Biden admin kept whispering sweet nothings to Zelensky and the EU, “We’ve got your back, boo.” Spoiler: the American people didn’t sign up for this rom-com. Our administrations and think tank geniuses did. And now? We’re stuck in a sitcom breakup scene, and Zelensky’s acting like he gets to keep the house… and the dog.

The Entitlement That Broke the Camel’s Back

Picture this: Zelensky strolls into the White House, arms flailing, eyes rolling like he’s auditioning for Real Housewives of Kyiv, telling Trump and Vance how it’s gonna be. Bro, we’re the ones cutting the checks, $200 billion and counting, while our bridges crumble and healthcare’s a GoFundMe side hustle. And you’re lecturing us? That’s not a negotiation, that’s a kid demanding dessert after spitting in your face.

Europeans don’t get it. They’re sipping espresso, retiring at 50, and wondering why we’re not RSVPing to their next war party. Newsflash: we’re pissed. We’ve been bankrolling their cushy lives, NATO’s basically a US taxpayer funded spa day, while they sneer at us like we’re the hired help. This isn’t an alliance, it’s a codependent mess, and we’re the ones stuck with the therapy bill.

Why We’re Dumping You (It’s Not Us, It’s You)

Here’s the kicker: we’re not even mad at Europe’s quality of life, good for you, universal healthcare and all that jazz. Why are we shelling out trillions to guard their borders while our own backyard’s a dumpster fire? It’s like paying your neighbor’s mortgage so they can renovate their pool… and then they complain your lawns not mowed.

Trump’s rage, Vance’s side-eye, that wasn’t partisan, that was American. Lefties who hate war, right-wingers who hate handouts, and everyone in between saw Zelensky’s entitlement and collectively said, “Nah, fam.” This isn’t about politics; it’s about self-respect. We’re not your ATM, and we’re damn sure not your punching bag.

Transition Time or Just Rip the Band-Aid Off?

Sure, an “orderly transition” sounds nice, like a polite breakup text with a smiley face. But after Zelensky’s Oval Office meltdown, I’m thinking we just block the number and move on. We’ll still trade, visit, maybe send a postcard or two. But Europe’s gotta grow up, pay its own tab, and figure out how to sleep without Uncle Sam’s nightlight.

Their leaders don’t see how deep this cuts, how much we’d rather fix our own potholes than pave their warzones. And that’s on them. Because when your charity case starts acting like they own you, it’s not a relationship… it’s a hostage situation.

So, here’s to new beginnings: Europe can call us when they’ve got their own army, and Zelensky can save the drama for his next Zoom with Putin. Until then, we’re keeping our wallet closed, because if we’re going down, it’ll be laughing, not groveling.

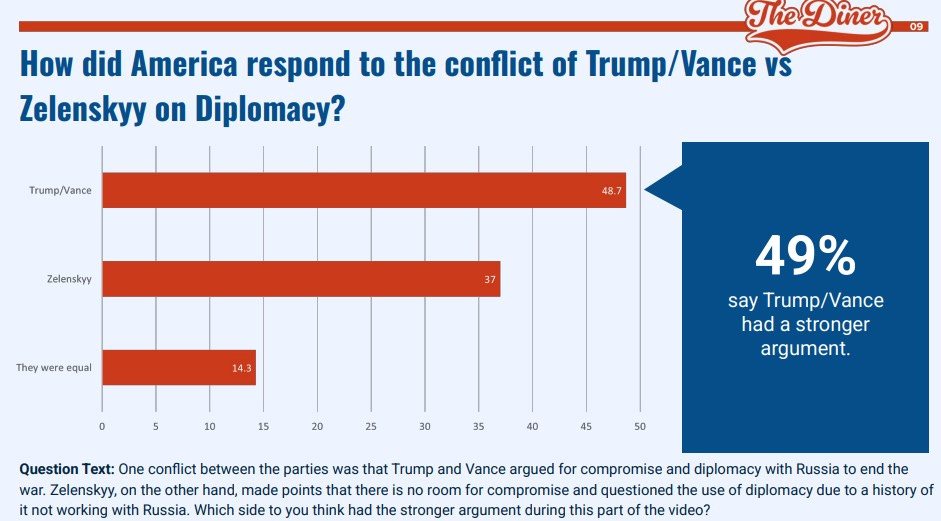

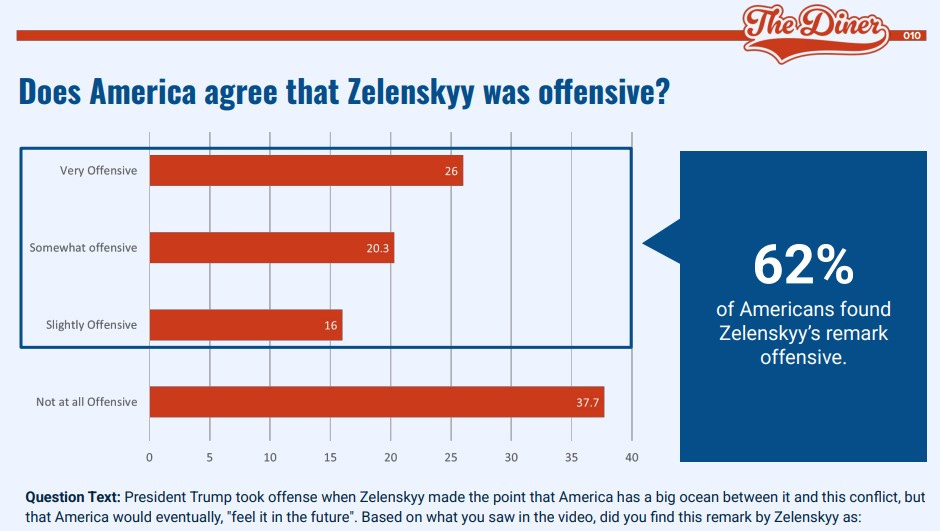

Mark Halperin had a survey of a 1000 people done over the weekend about the meeting. Before completing the survey, they had to watch the entire 10-minute exchange. Here is a link for the entire survey:

Closing Thoughts: The Macro Circus Rolls On

Markets are jittery with tariffs, Fed uncertainty, and China’s upcoming policy moves.

Trump’s Crypto Reserve play smells fishy, expect fireworks at Friday’s White House Crypto Summit.

Powell’s Friday speech could set the rate cut tone for the next few months.

The FDIC is hiding banking data: a sign that things are shakier than they admit.

And Europe? They better start saving for their own defense fund, because America just walked out the door.

So, if you love chaos, this week is loaded with tariff fallout, crypto chaos, and economic landmines. Stay tuned, and don’t believe everything the government tells you. Especially when they stop telling you things altogether.

Until next time, stay sharp, stay skeptical, and stay sane.